Home buying mandates a series of small decisions. Do I live in the city or in the suburbs? How many bedrooms do I want to have? How far is the location from my work environment?

All of these decisions cumulate in one large one: Where will I live?

For many prospective home buyers, the first step is to determine your budget. To calculate what type of home you can afford, it's crucial to first know your monthly income. Secondly, determine your total monthly expenses, including items such as credit card bills, insurance premiums, and car payments.

When synthesizing this information, consider reaching out to a financial professional. For example, a housing counselor can help you determine what you can reasonably afford. By keeping your payments within an affordable budget, you can avoid potential financial hurdles, such as foreclosure.

Mortgage lenders will tell you the amount of the loan they're willing to offer you. This takes your ability to repay the loan into consideration. That said, it's probably safe to say that you comprehend your socioeconomic situation better than anyone, so invest thorough thought into one of the biggest decisions you'll ever make.

For more information on the finances of home buying, contact Michna Law Group by phone at 847.446.4600 or by email at BJM@MichnaLaw.com.

This blog is courtesy of Michna Law Group, a real estate law firm based out of Northbrook.

Wednesday, March 29, 2017

Monday, March 20, 2017

House Flipping: An Update

Investopedia defines "flipping" as "A type of real estate investment strategy in which an investor purchases properties with the goal of reselling them for a profit. Profit is generated either through the price appreciation that occurs as a result of a hot housing market and/or from renovations and capital improvements. Investors who employ these strategies face the risk of price depreciation in bad housing markets."

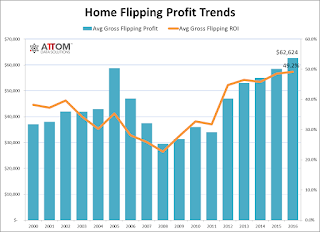

Beginning as a day-trading trend in the early 2000's, house flipping has seen continual increases in business throughout the country's real estate market. As a matter of fact, RealtyTrac recently reported house flipping saw a 3% increase in 2016, leading this trend to a ten-year high.

Meanwhile, Illinois as a whole has landed in the top five states with the highest gross flipping ROI as evidenced by the infographic below.

With 2016 being a record-high year in a decade for house-flipping, it's difficult to picture the trend slowing down any time soon. This could be especially true due to the next statistic.

Although house flipping is at a ten-year high, Crain's Chicago Business reported that Illinois' home inventory levels are at a ten-year low.

"In the week that ended Jan. 7, 7,028 homes were on the market in the city, according to a report posted by the Chicago Association of Realtors on Monday. That's the lowest recorded in CAR's data, which goes back to January 2007. It's 3.7 percent below the inventory on hand at the same time last year, when the 7,297 listed homes were the lowest recorded."

With a low inventory, it's easier for real estate investors to flip houses in a timely manner. This is because prospective home buyers have fewer options to consider in the market.

However, despite having the ability to make a quick profit on a home flip, be wary. Despite being able to potentially make a quick buck with a flip, there are a few disadvantages including issues with cash flow and tax management. Even worse, those attempting to get involved with house flipping may find that it's easier is theory than it is practice.

Investopedia actually prepared a list of some qualities exhibited by those who run into issues with a home flip, including the lack of:

- Money

- Time

- Skills

- Knowledge

- Patience

Each of these items in their own right, can prove to be detrimental, especially to first-time house flipper. But as long as you do your research and invest some time into your house flipping expeditions, these shouldn't be an issue.

For all of our real estate legal needs, contact Michna Law Group by email at BJM@MichnaLaw.com or by phone at 847.446.4600.

Wednesday, March 8, 2017

Economic Growth Triggering Housing Demand

With spring homebuying around the corner, we would like to take a look back on last spring's market. In spring of 2016, we were treated to mortgage rates below 4%, even dropping as far as 3.4% in the summer. However, this year started out with mortgage rates already at 4.25%.

Despite this statistic, January existing home sales numbers saw a dramatic increase, setting the fastest pace in nearly a decade. So what does this mean? Well, it could be a trigger moment in the housing market. This is all in the face of low inventory and median home prices increasing for 59 straight months.

A cause for these conflicting statistics can be an increase in household income. Changes in economic conditions and consumer access to mortgage financing are also important influences on homeownership. Overall, one's decision and ability to buy a home is closely tied to all of these economic factors. Recently improving economic conditions have helped fuel a resurgence in the homeownership rate.

While it's difficult to predict future economic conditions, a growing economy and rising income levels play a role in increasing homeownership. Higher household incomes and continued good news on the economy are also increasing demand to buy a home as we enter the spring home buying season. This may be the trigger moment that pushes the housing market to a whole new level.

A cause for these conflicting statistics can be an increase in household income. Changes in economic conditions and consumer access to mortgage financing are also important influences on homeownership. Overall, one's decision and ability to buy a home is closely tied to all of these economic factors. Recently improving economic conditions have helped fuel a resurgence in the homeownership rate.

While it's difficult to predict future economic conditions, a growing economy and rising income levels play a role in increasing homeownership. Higher household incomes and continued good news on the economy are also increasing demand to buy a home as we enter the spring home buying season. This may be the trigger moment that pushes the housing market to a whole new level.

Subscribe to:

Posts (Atom)