When this number is compared to the national average (1.211%), Illinois is nearly double the rate. More so, Illinois has the highest median tax rate in the nation at 2.67%. Add in the fact that Illinois' metropolitan area in Chicago being nationally ranked as the worst real estate market, and things don't look too sharp. Despite these statistics, Illinois' housing inventory (supply) is smaller than its demand.

So what does all of this mean?

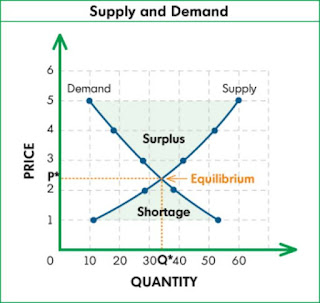

Frankly, there couldn't possibly be a better time to sell your home. In a traditional supply and demand model, low supply reflects high demand which in turn, generates higher prices. As a homeowner, you can take advantage of the housing market.

For assistance with selling your home, contact Michna Law Group by phone at 1.847.446.4600 or by email at BJM@MichnaLaw.com.

No comments:

Post a Comment